A reader recently wrote in with a question about asset allocation in retirement, having been advised that anyone in retirement should have at least 80% in equities.

He’ll be retiring at age 66 later this year and, based on everything that he’s read, this recommendation seemed quite high to him.

While I’m not in the business of offering specific investment advice on an individual basis, I am (as always) more than happy to tackle subjects like this in general terms, and to provide my own personal perspective.

For starters, I’ll just say that it’s incredibly dangerous (IMHO) to apply hard and fast rules (e.g., retirees should have at least 80% in equities) when it comes to things like asset allocation. There are a number of variables at play, and what’s right for one person might be completely wrong for another.

Said another way, there really is no one best asset allocation in retirement — or at any other stage of life, for that matter.

Determining your ideal allocation

In very general terms, it’s been said that you should consider your willingness, ability, and need to take risks when determining your proper asset allocation. Using my own situation as an example…

I consider myself to be rather risk tolerant. For example, I didn’t lose a wink of sleep as the market plummeted and our (paper) losses piled up from 2007-2009. In fact, I was barely paying attention. I am thus quite willing to take risks — at least when they make sense.

And we do have the ability to take on a fair amount of risk thanks to my relatively stable, well-paying job as well as the fact that we have a fairly sizable investment portfolio and a nice cash cushion. But, of course, I’m not retired. The situation will likely change as I deplete my “human capital.”

As for the need to take risk… For many of the same reasons that we’re able to take financial risks, we don’t have a whole lot of need to do so. We’ve thus opted to keep things somewhat conservative, with a 60/40 stock-to-bond allocation.

(More details here: Our Investment Portfolio)

While your willingness to take risks is largely psychological, the other two factors — ability and need — are largely financial. And, in many cases, they may be negatively correlated. That is, if you have the ability to take risks, you may not have the need. And if you have the need to take risks, you may not have the ability.

The point of all this is that asset allocation decisions are highly personal. They depend on many things, including your state of mind, your timeframe, how much money you actually have, the cost to maintain your current lifestyle, your willingness to change said lifestyle, etc., etc., etc…

Historical expectations

Returning to the 80/20 recommendation mentioned above, I should note that such an allocation has an expected annual return (in a total market sense) of roughly 9.4% based on historical data. Sounds good, right? Well…

It’s worth keeping in mind that this same allocation has (historically) lost as much as 34.9% in a single year, and that a little over a quarter of all years have experienced a loss of some sort. So yes, there will definitely be some significant ups and downs.

These numbers alone doesn’t make an 80/20 allocation a bad idea for someone entering (or in) retirement — remember, there are many factors to consider here. But I will say (once again, IMHO) that an 80/20 allocation strikes me as rather aggressive for someone who is relatively late in their investing life.

Industry recommendations

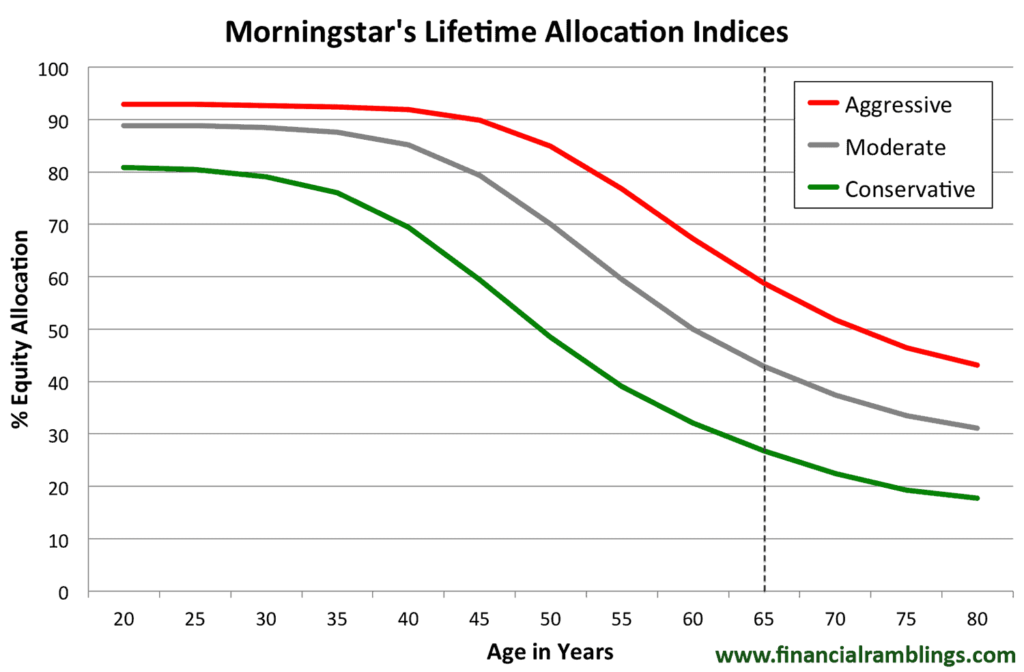

Another bit of perspective comes from current investment industry practices. I threw together the following graph of the recommended equity allocation at various ages based on the Morningstar Lifetime Allocation Indices.

These data come from June 2012, so the numbers are fairly current. For reference, the vertical, dotted line marks the traditional retirement age of 65.

Sure, you could argue that this graph is but a single data point, representing Morningstar’s opinion to the exclusion of all else. That’s technically true, but…

They’ve also compared the equity allocations of the twenty largest target-date retirement funds to these numbers, and guess what? They all fall almost entirely within the conservative/aggressive bounds across their entire glide paths.

In other words, this graph gives you a pretty good idea of current recommendations. And, as you can see, 80% equities falls pretty far above the range for retirees.